Total grocery sales in the UK jumped more than 7.5% in the run-up to Christmas, according to new data released by Kantar, helped by a slight dip in price inflation.

However, the data insight and consultancy points out that while sales did reach a record £12.8 billion, volumes were down by 1% year over year. One of the driving forces behind the surge this year at least in terms of spending, Kantar says, were “value sales” and consumers using their earnings wisely and dodging high-priced brands.

“Consumers continued to trade down to supermarkets’ own-label products this period, with sales rising by 13.3%, well ahead of a 4.7% increase in branded lines,” wrote Fraser McKevitt, Head of Retail and Consumer Insight for Kantar’s Worldpanel Division, UK. “The British supermarket sector is more competitive than ever, and the grocers are keen to retain customers by offering their own festive alternatives.”

The drop in inflation from 14.6% to 14.4% just prior to the holidays – effectively, the 12-week period studied by Kantar – helped a bit. Even though consumers closely watched their spend, they were able to land some premium, own-label products. Christmas puddings rose by 6%, for example, while customers steered away from items such as Brussels sprouts (down 3%).

“This is the second month in a row that grocery price inflation has fallen, raising hopes that the worst has now passed,” McKevitt noted. “However, it’s still a painfully high figure at the current rate, impacting how and what we buy at the shops.”

This year’s sales boost in December was £1.1 billion higher than last December, spurring another record 9.4% growth during the month. It was fueled not only by the festive period but also the World Cup earlier in the month.

The top day for sales was 23 December, with shoppers heading to supermarkets 5% more than they did in 2021. Consumers also increased their spend on value sales online at +4% though again volumes did decrease slightly. “Inflation’s impact can be seen on this part of the market too as the average cost of a virtual basket now sits at £93.06,” McKevitt said.

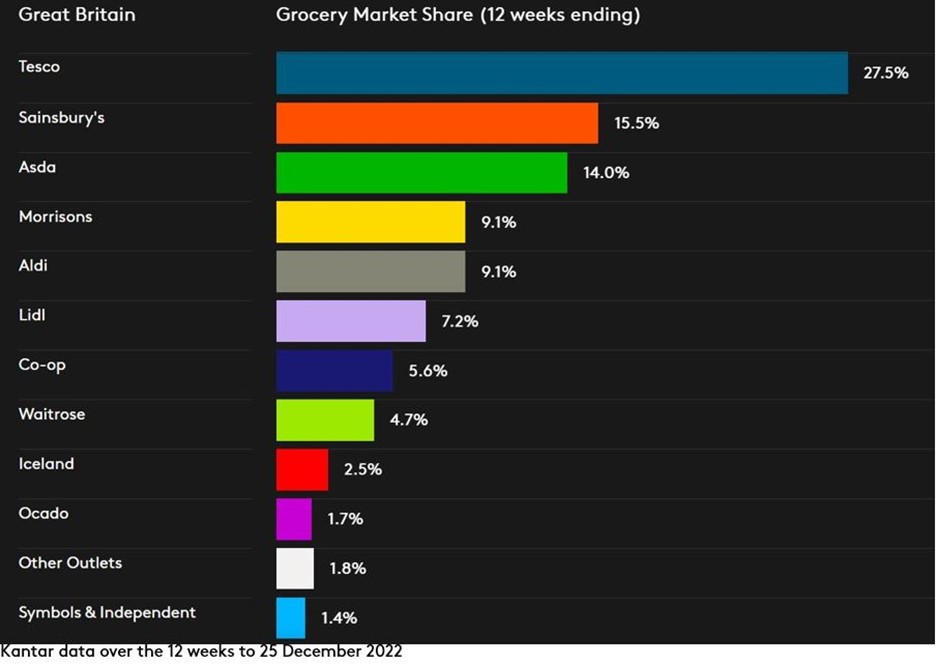

One of the top-performing stores was Asda, whose sales leapt 6.4% to beat out Sainsbury’s (6.2%) and Tesco (6%). Even though sales dipped by nearly 3% at Morrisons, it enjoyed its best month since the middle of 2021 and pulled back into a tie with Aldi for overall UK market share at 9.1%. Still, it is hard to deny the impact of Aldi and Lidl, deep discounters who gained large percentages of share year over year because of their low price points throughout their stores.